BA (Hons) in Accounting and Finance with a specialism in Taxation

This programme is specifically designed to provide:

Specialised knowledge and understanding of relevant theories concepts and principles relevant to the field of taxation.

Abilities to interpret, communicate and develop tax laws & devise plans for organizations or individuals.

A critical understanding of the economic, legal and institutional bases of systems of taxation and their applications with emphasis on business taxation.

Subjects:

- Quantitative and Statistical Methods

- Introduction to Management

- Business and Communication Skills

- Financial Accounting 1

- Business Economics

- Islamic Finance

- Financial Accounting 2

- Accounting Information Systems

- Business Law

- Marketing

- Fundamentals of Entrepreneurship

- Advanced Financial Accounting

- Introduction to taxation

- Financial Management

- Cost and Management Accounting

- Auditing and Assurance

- Integrated Business Processes with SAP ERP System

- Corporate Reporting

- Business Research Methods

- Management Accounting Techniques

- Company Law

- Advanced Auditing

- Tax Framework

- Internship (16 weeks)

- Ethics and Corporate Governance

- Corporate Finance

- Advanced Taxation

- Strategic Management Accounting

- Business Analysis

- Financial Technology Services

- Financial Risk Management

- Business Taxation

- Tax Planning

- Tax and Accounting

- Investigation in Taxation

- Taxation Project

- Ethnic Relations (M’sian Students)

- Islamic & Asian Civilisation (M’sian Students)

- Malaysian Studies (Int’l Students)

- Malay Communication Language (Int’l Students)

- Workplace Professional Communication Skills

- Employee & Employment Trends

- Co-Curriculum

Overview

INSTITUTION

MODE OF STUDY

Full-time

EDUCATION LEVEL

Degree

CATEGORY

Accounting & Finance

Intakes and Duration

February

3 years

April

3 years

September

3 years

Fees

Course Fee

RM84,300

Entry Requirements

STPM/A Level/Foundation/Matriculation

Successful completion of STPM with 2 full passes or equivalent with minimum CGPA of 2.33 and completion of SPM or equivalent with credit in Mathematics and pass in English. Successful completion of A-Level with 2 full passes or equivalent and completion of O-Level/SPM or equivalent with credit in Mathematics. Credit passes (Grade B) in 5 Subjects including Mathematics. Successful Completion of APU Foundation / Matriculation with a minimum CGPA of 2.5 and completion of SPM/O-Level or equivalent with credit in Mathematics and pass in English.

Subjects

Accounting & Finance

Similar Courses

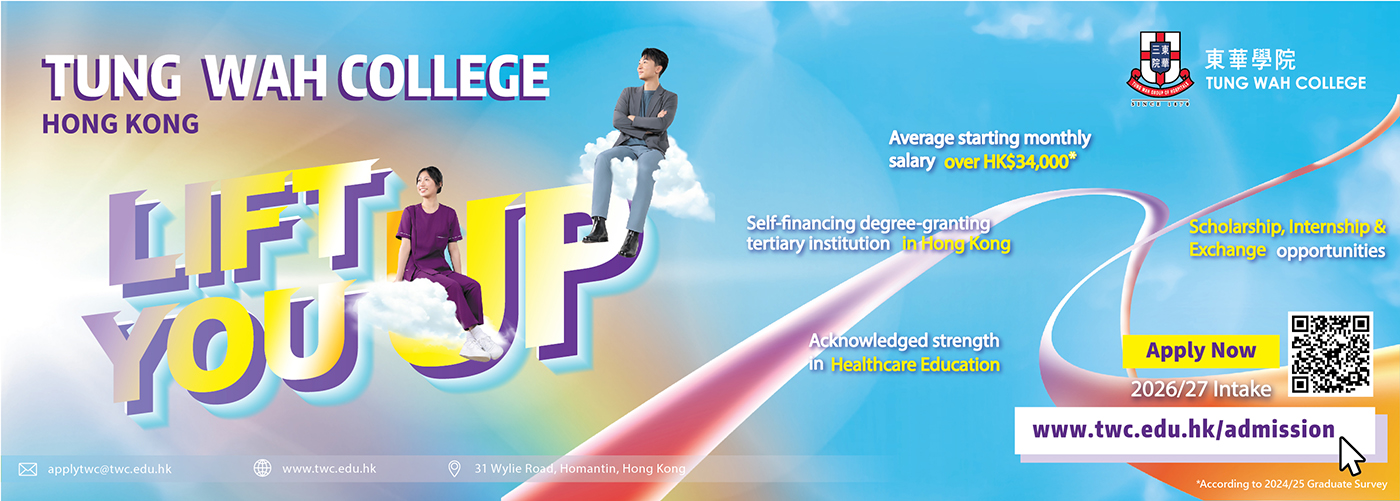

BA (Hons) in Accounting and Finance with a specialism in Taxation

ASIA PACIFIC UNIVERSITY (APU) / ASIA PACIFIC INSTITUTE OF INFORMATION TECHNOLOGY (APIIT)

Bachelor of Business (Honours) Accounting and Finance

TUNKU ABDUL RAHMAN UNIVERSITY OF MANAGEMENT AND TECHNOLOGY (TAR UMT)

Bachelor of Finance (Honours)

TUNKU ABDUL RAHMAN UNIVERSITY OF MANAGEMENT AND TECHNOLOGY (TAR UMT)

BBA (Hons) Finance

UM-Wales

Banking and Finance with Islamic Banking (BSc)

UNIVERSITY OF NOTTINGHAM MALAYSIA

Bachelor of Accountancy (Hons) (Penang Campus)

UOW MALAYSIA UNIVERSITY COLLEGE

BA (Hons) in Accounting and Finance

ASIA PACIFIC UNIVERSITY (APU) / ASIA PACIFIC INSTITUTE OF INFORMATION TECHNOLOGY (APIIT)

Bachelor of Business Administration (Hons) in Islamic Finance

UM-Wales

Bachelor of Science (Honours) in Accounting & Finance [Top-up]

SIM GLOBAL EDUCATION

BSc Accounting and Finance

UNIVERSITY OF READING MALAYSIA