Jobs in Finance

Finance is a broad area that covers the evaluation and management of investments and spending. It is also a study of the processes of investing and raising money as well as financial planning. There is a variety of diploma and degree programmes available to students after they have completed secondary school or pre-university. These programmes range from pure Finance courses to courses that combine Finance with other related areas such as Business, Accounting, Banking, Economics and Investment.

Here are some popular career pathways for finance graduates:

Corporate Finance

This is the area of finance which covers the optimal use of a company’s financial resources by dealing with the arrangement of funds for various projects at minimum cost. Corporate finance is important to ensure the company’s capital structure is maintained. Individuals working in corporate finance are responsible for maximising corporate value and reducing financial risk. Daily tasks include devising the company’s overall financial strategy, forecasting profits and losses, negotiating lines of credit, preparing financial statements and coordinating with outside auditors. Some of the popular job positions in corporate finance are Financial Analyst, Cost Analyst, Credit Manager, Cash Manager, Benefits Officer, Investor Relations Officer and Treasurer.

Banking

Finance graduates can venture into the two main branches of banking which are commercial banking and investment banking. Commercial banks accept deposits, make loans, safeguard assets and liaise with a variety of clients. Individuals who prioritise work-life balance and enjoy interacting with clients may consider pursuing a career in commercial banking. Job titles in commercial banking include Bank Teller, Loan Officer and Branch Manager. On the other hand, investment banking covers the services provided to large companies and investors such as large-scale financing and merger & acquisition transactions. Some of the job positions in investment banking are Investment Banking Analyst and Investment Banking Associate.

Public Accounting

Generally, accountants prepare and analyse accounting records, financial statements and financial reports to make sure they are accurate and adhere to procedural standards. They are in charge of taxation matters such as taxes owed, tax returns and tax payment. Accountants provide advice and help with business decisions by analysing trends, costs and revenues. Those with accounting qualifications can find employment in many industries. They can work in Financial Accounting, Tax, Audit, Management Consulting and Risk Consulting. Some of the job titles within the realm of accounting are Auditor, Accountant, Business Consultant, Tax Consultant, Financial Advisor and Financial Analyst. The main employers of accountants are accounting firms, private, public and non-profit organisations. Some of the leading accounting firms worldwide are PricewaterhouseCoopers (PwC), Deloitte, Ernst & Young (EY) and KPMG.

Insurance

The insurance sector helps businesses and individuals plan for potential risks and find ways to protect them from losses in the future. Insurance companies provide several types of coverage such as life, health, auto, property, and casualty insurance. There are a number of job opportunities suitable for finance graduates in the insurance field. These positions include Financial Planner, Claims Analyst, Claims Clerk, Customer Service Representative, Sales Agent, and Underwriter.

Careers in finance will always be available and relevant because all business ventures deal with elements of finance, especially in the areas of growth and profit. Investment and funding decisions rely greatly on finance as well. In addition, finance plays an important part in ensuring the health of the overall economy.

Advices

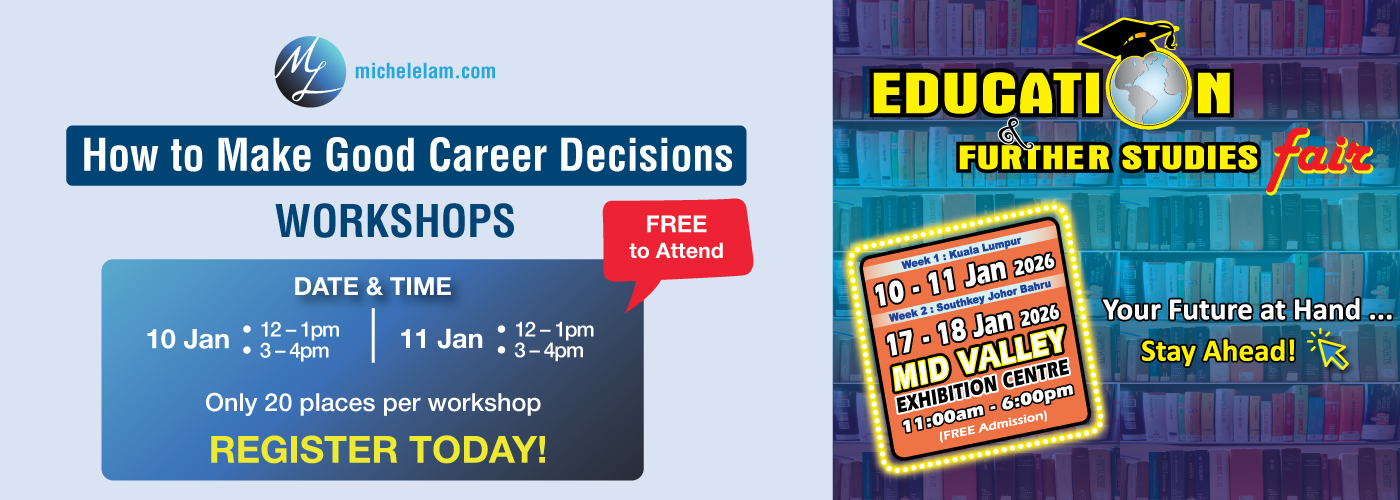

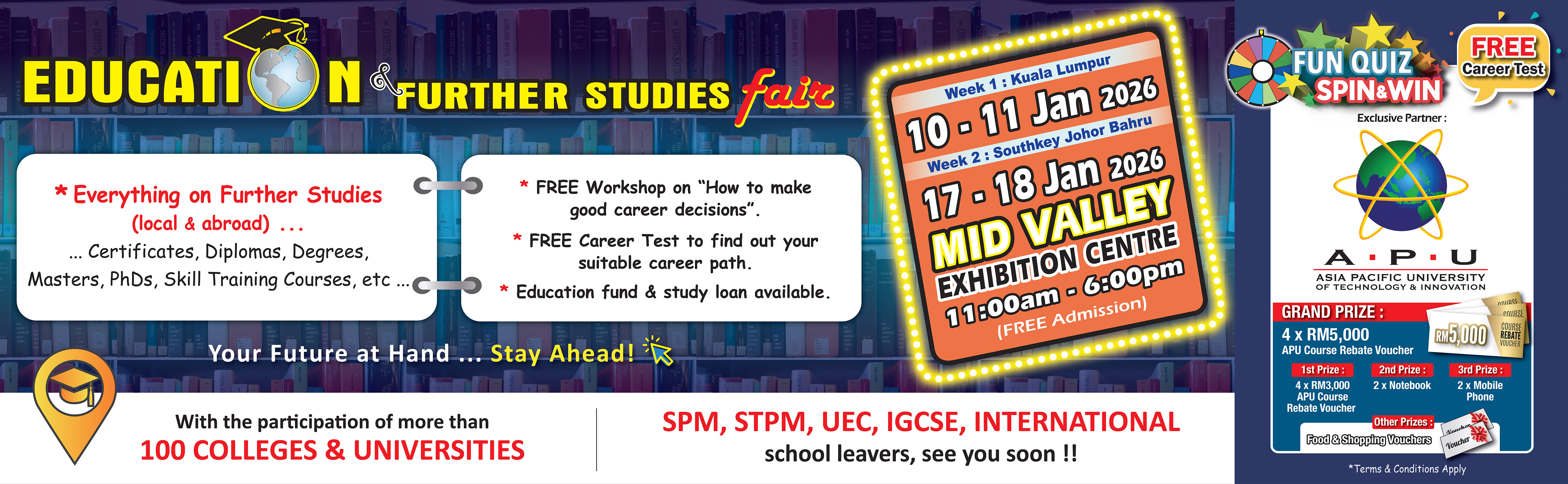

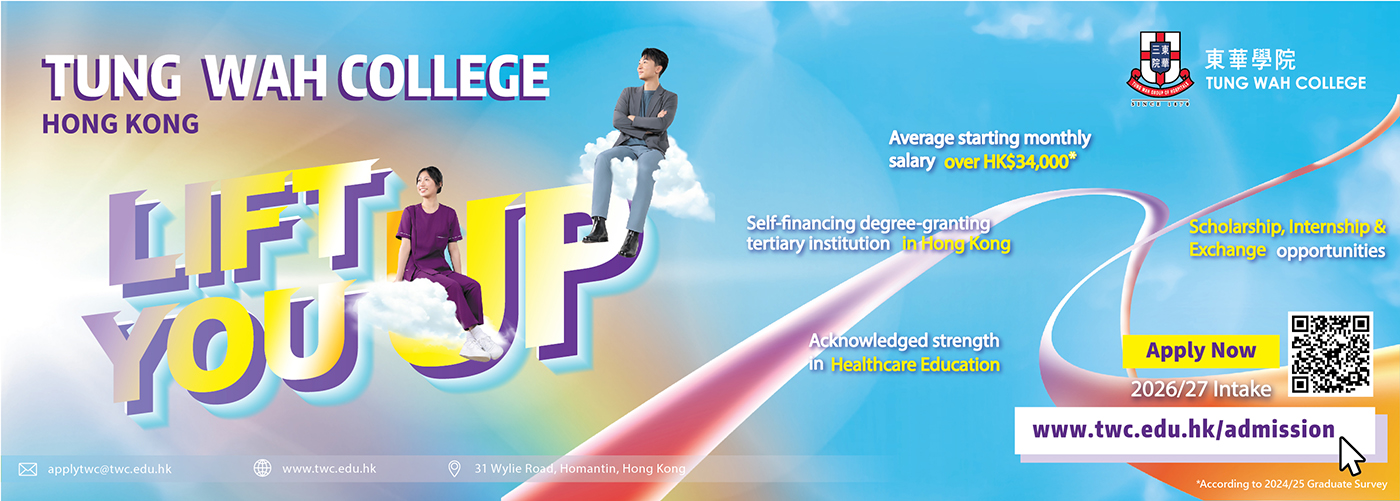

News from Institutions